Clients

Family groups

We are artisans of your wealth

360° perspective

At DiverInvest, we provide comprehensive advice on family wealth from a global perspective, where the next generation plays a crucial role. The objective is to grow the wealth from generation to generation, minimizing the tax impact, risks and costs.Comprehensive advisory

We assist you in all areas requiring professional advice, including family protocol, wealth planning, financial advice, financial investment control, private equity or real estate, wealth transfer to the next generation, taxation, and training.Personalized approach

We coordinate each phase of a family's financial life by adapting to the family protocol and offering solutions that are always tailored to the wealth needs.

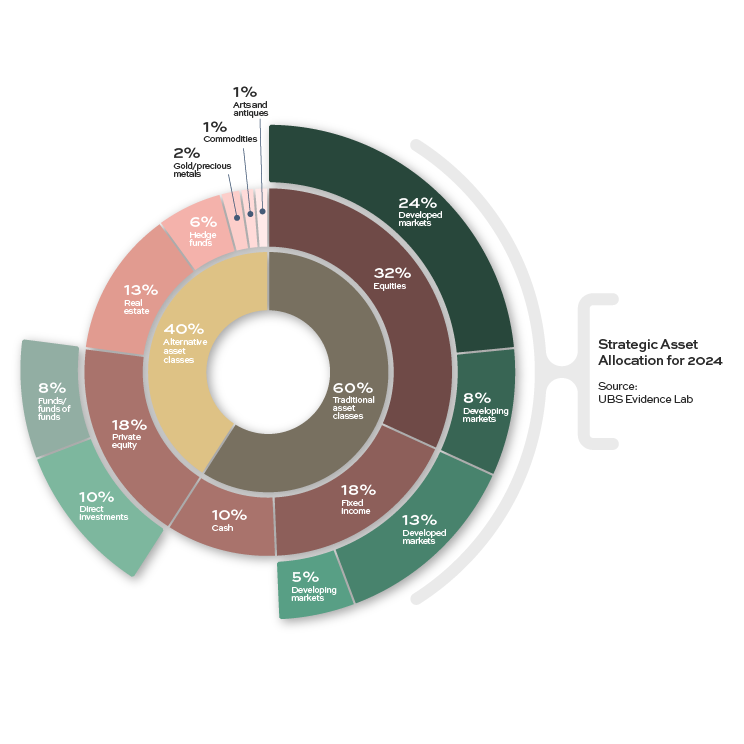

Asset distribution

Have you ever wondered how your wealth is distributed across different asset classes?

At DiverInvest, we will help you distribute your wealth in an efficient way, diversifying risks and considering often overlooked aspects.

Thus, an ideal strategic approach will encompass both listed and unlisted financial assets, such as private equity, real estate or art, among others.

Foundations, congregations and institutions

Specialists in endowment

Support for the management team and governing bodies

The DiverInvest team works in alignment with established ethical and investment principles. Alongside the board of trustees and governing bodies, it provides support and advice to the management team in achieving their goals. Additionally, it actively participates in the economic commission and board meetings, as required.Adapted to the specific ethical code

Foundations, associations, and congregations have unique characteristics that set them apart from other investors. At DiverInvest, we have an in-depth understanding of these organizations. We not only adapt to their structures but also align with their ethical codes in both actions and product recommendations.Extensive experience in endowment

Most foundations or institutions govern their actions based on the concept of endowment. This involves a special fund where the principal must remain intact over a specified period, and the income earned on the principal has to cover annual expenses and inflation.

ESG Investments

Since its beginning, DiverInvest has conducted its activities with a strong social and sustainability focus. In 2019, we voluntarily started reporting to thePrinciples for Responsible Investment (PRI). Additionally, we have embraced the ESG (Environmental, Social and Governance) categorization, applying specific values to our recommendations and extending them to our company’s governance.

Furthermore, at DiverInvest, we have introduced the concept of the Responsible Investor, who opts for impact investing in social and/or environmental aspects to contribute to improving society without sacrificing financial returns.

Individuals and companies

Tailored investments

Our clients' needs

Effective advisory for your investment portfolio often requires a prior analysis of wealth planning. This analysis allows the DiverInvest team to deeply understand your needs and current situation, enabling us to provide you with better-personalized advice.Other determining parameters

In addition to wealth situation and temporal implications, when advising, we take into account other parameters such as your risk aversion, preference for specific products, or the sustainability impact of your portfolios.Minimizing risks and reducing costs

Another distinctive aspect is our commitment to reducing risks and costs associated with depositary entities. DiverInvest has an extensive list of top national and international entities offering favorable conditions for our clients' benefit.

Decision-making factors

As investors, you face a daily influx of information which can create uncertainty in wealth decisions. These situations often generate social pressure, biased judgments, and sometimes overconfidence. Depending on your specific risk aversion, these inputs could lead to inappropriate decisions.

DiverInvest’s role is to accompany you in this decision-making process. We provide our rational perspective amidst market fluctuations and consistently align ourselves with your goals as Independent Financial Advisers (IFA).

Let's talk about it ?

Share your needs with us and discover how we can assist you.